Venture Literacy

Reading Resources

-

The 30–60–90 Day Venture Roadmap: Turning Momentum into Mastery

-

Execution and Action: Tools, Dashboards, and OKRs for Sustainable Growth

-

The Human Core: Articulation, Empathy, and Creative Intelligence

-

From Investment to Venture: Turning Ideas into Viable Businesses

-

From Home CFO to Venture CFO: Managing Growth Like a Professional

-

"Habits That Compound: How Small Wins Create Financial Freedom"

-

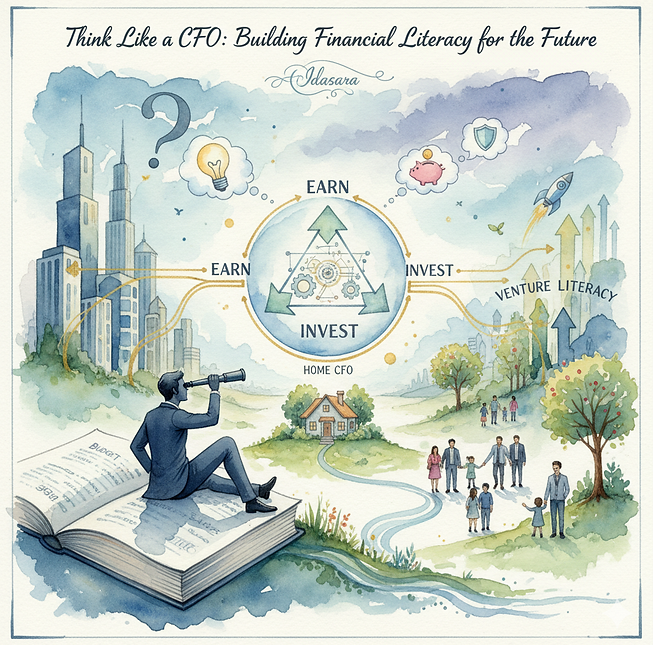

Think Like a CFO: Building Financial Literacy for the Future

Think Like a CFO: Building Financial Literacy for the Future

The Mindset Before the Mathematics

Financial literacy has long been defined by its tools — budgets, bank accounts, and balance sheets. But at Idasara, we see it differently. True financial literacy begins not with the numbers, but with the mindset behind them. To “think like a CFO” is to view every financial choice — personal or professional — as a strategic decision with ripple effects across time. It is to replace impulsive transactions with intentional trade-offs, to translate money from a medium of exchange into a medium of purpose.

A CFO’s view is panoramic. It sees today’s expenses in the context of tomorrow’s sustainability. It weighs opportunity against risk, and it builds systems that make discipline easier than spontaneity. When families, students, or young entrepreneurs adopt this frame, they no longer see money as something to be managed — they see it as something to be mobilized.

The E-S-I Framework: A Simple Architecture for Complex Lives

At the heart of this shift lies our foundational model — Earn, Save, Invest (E-S-I). It is deceptively simple, yet structurally profound. Every individual, every household, and every business exists somewhere on this spectrum. In practice, E-S-I is less about financial sequencing and more about behavioral alignment. You earn to build capacity; you save to build security; you invest to build growth. Each dimension reflects a different way of relating to time.

When people learn to earn effectively, they move from survival to surplus — from working for income to creating value that others will pay for. When they learn to save intelligently, they create options; they buy themselves freedom from urgency. And when they invest wisely, they build momentum that compounds even while they rest. Together, these three habits transform reactive living into proactive design.

Why Every Family Needs a CFO

In a company, the CFO protects stability while enabling growth. In a family, that responsibility is no less crucial. Households that operate without a financial plan are like startups without a budget — even small shocks can cascade into crisis. To think like a family CFO is to view your household as an enterprise with its own profit and loss dynamics. It means asking: Where is our capital going? What are we really investing in? How do we balance current comfort with future resilience?

Most Sri Lankan families already intuitively practice parts of this model — saving for education, prioritizing health, or building a home. But formalizing this discipline through tools like Idasara’s Home CFO model brings structure to intuition. It reframes family finances as a learning environment for children, a decision laboratory for parents, and a generational safety net for the future.

From Arithmetic to Agency

The great tragedy of financial education is that it often ends at arithmetic. We teach children to count coins but not to design systems. Yet, literacy without agency creates knowledge without power.

When people learn to interpret money through the lens of agency — as a resource that can be directed toward purpose — their relationship with it fundamentally changes. Saving is no longer an act of fear; it becomes an act of freedom. Investing ceases to be speculation; it becomes contribution.

This is why Idasara’s programs start with narrative before numbers — the story we tell about money determines what we do with it.

The CFO’s Habits of Thought

Executives don’t just manage; they measure, forecast, and review. The same habits can elevate personal finance:

1. Forecast beyond the month. A CFO plans across quarters and years, anticipating both growth and risk. Individuals can do the same — think in horizons, not paychecks.

2. Separate data from noise. Track your financial flows, but don’t react to every fluctuation. Systems — not emotions — drive sustainability.

3. Revisit assumptions. Good CFOs know that yesterday’s model may not fit today’s reality. Every six months, review not just your expenses, but your intentions.

These are small disciplines, but they build the foundation for what we call venture literacy — the ability to translate financial understanding into entrepreneurial confidence.

The Bridge to Venture Literacy

When financial literacy matures, it evolves into something larger — the literacy of venture. This transition is not about starting a company; it is about adopting an entrepreneurial posture toward life itself. Venture literacy is the ability to identify opportunities, manage risk, and allocate capital — whether that capital is money, skill, or time.

For example, when a young graduate learns to save systematically, they accumulate not only cash but optionality. That optionality — the ability to choose — is the seed of entrepreneurship. Similarly, when a family learns to plan cashflows, they are essentially modeling what a small business does every day. In this sense, the CFO mindset is the bridge between financial prudence and entrepreneurial courage. It grounds dreams in data and converts spreadsheets into stories of transformation.

The Idasara Approach

At Idasara, we teach people to earn, save, and invest — but more importantly, to align those actions with personal purpose. Through our workshops, micro-VC programs, and AI-assisted tools, we help individuals see that finance is not a department of life; it is the infrastructure of possibility. Our Home CFO, Venture CFO, and AI CxO Agent models are designed to evolve with each stage of the learner’s journey — from household budgeting to startup scaling. When people learn to think like CFOs, they become stewards of their own futures, not subjects of circumstance.

The Call to Reflection

Before you make your next financial decision, pause for a moment and ask the questions a CFO would ask:

What value will this create?

How does this decision serve my long-term strategy?

What is the risk I’m not seeing?

Financial literacy, when practiced this way, ceases to be a task and becomes a philosophy — a lens for living.

In Closing

To “think like a CFO” is to adopt a posture of stewardship — over one’s resources, ambitions, and responsibilities. It is the starting point of the Idasara journey from financial literacy to venture literacy. As families, youth, and entrepreneurs across Sri Lanka embrace this mindset, they do more than balance budgets; they build futures.

Financial literacy is the first investment. Venture literacy is the dividend.